A Guide to Office Space in Naples

If you are searching for an ideal location to place your business offering the best of everything, then Naples, FL, is it! Naples, FL, boasts the title of the world’s golf and pickleball capital and is considered to be one of the finest cities in the United States. Naples has no shortage of attractions, from its pristine white sand beaches to its flourishing and diverse economy.

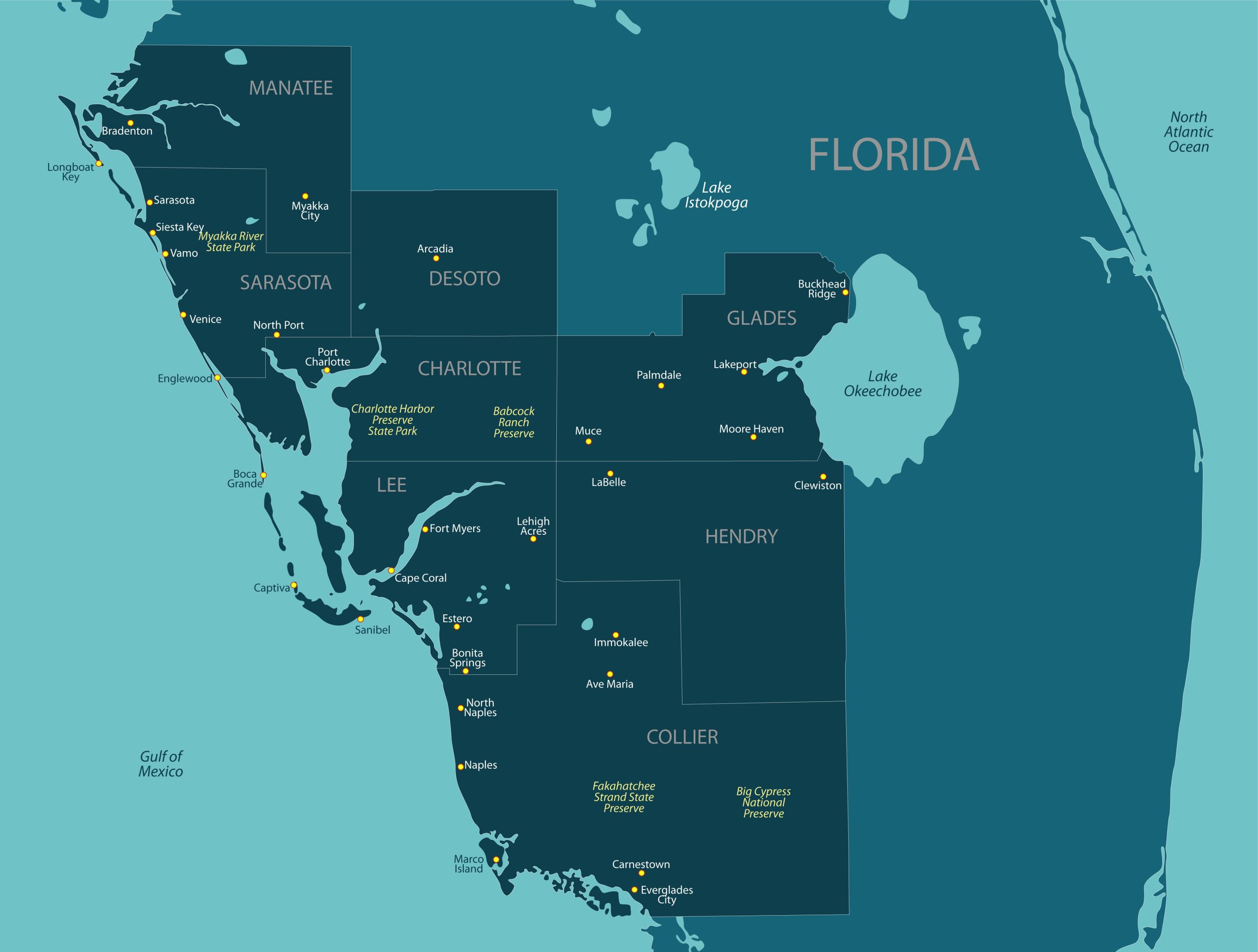

Naples is an excellent location to establish your business headquarters, thanks to its dynamic and expanding population of approximately 22,000 and a surrounding metropolitan population of approximately 375,000. In Naples, there is no shortage of things to do, from an array of upscale shopping and dining options to a wide variety of options for that healthy, active lifestyle.

Southwest Florida is seeing tremendous financial, banking, construction, and professional services growth. Naples has become top of the list for professionals and businesses alike, with Florida Gulf Coast University nearby, top medical professionals and services, and a Blue Zone-committed quality of life. In addition, Naples was also recently ranked by U.S. News as the safest place to live. Naples is the ideal location for any company looking to grow and succeed.

Top Areas of Interest in Naples

Looking at the various communities in Naples Proper, it is divided into Downtown Naples, Olde Naples, North Naples, Pelican Bay, Park Shore, and Pine Ridge.

Historic Downtown and Old Naples

The heart of Naples city is found in the Historic Downtown Naples and Old Naples areas, which are home to great restaurants and shops. These areas are surrounded by Naples Bay and the stunning Gulf of Mexico. Visitors can also explore the historic Tin City and enjoy shopping, dining, and visiting the Naples Pier. Additionally, a new Four Seasons 125-acre resort will be opening in Downtown Naples in 2024.

North Naples

In North Naples, discover the perfect combination of modernity and luxury with high-end shopping and dining options like Waterside Shops and Mercato, along with two Ritz Carlton Hotels. Our Concierge Executive Offices, conveniently located at 999 Vanderbilt Beach Rd, are situated near these destinations, making them the perfect choice for your stay and offices the perfect choice for your business.

North Naples offers a diverse range of experiences near our prime location at Concierge Executive Offices, from cultural landmarks such as Artis Naples, The Baker Museum, and The Golisano Children’s Museum to an active and healthy lifestyle with powdery beaches, turquoise Gulf of Mexico, and numerous golf courses, tennis, and pickleball courts.

Pelican Bay

Pelican Bay, adjacent to Concierge Executive Offices, is undoubtedly one of the most desirable locations in Naples, renowned for its picturesque tree-lined streets, exclusive beach access, and opulent living options. Its proximity to popular attractions such as Artis Naples, The Baker Museum, Waterside Shops, and Mercato gives it a distinctive urban flair. The area is surrounded by a whopping 88 acres of parks and recreation areas, making it the perfect venue to impress clients. With the Naples Airport conveniently located nearby, executives can take advantage of Concierge Executive Offices, virtual and physical office space, and professional conference rooms whether they are just visiting or coming home. Professionals seeking white glove services and amenities can find them at Concierge Executive Offices located at 999 Vanderbilt Beach Road.

Park Shore

Park Shore, situated north of Pelican Bay, is a lively community that provides effortless access to the beaches, canals, and an array of access to nearby shopping, dining, and cultural amenities in North Naples. It’s an exceptional fusion of classic and contemporary Florida.

Pine Ridge

Pine Ridge, located in Naples, offers effortless access to the primary highway, I-75, and other routes, making travel in and around the city convenient. It is composed of both gated and non-gated communities and is situated between North Naples and Downtown Naples. Pine Ridge is in the heart of North Naples’ shopping, dining, arts, and other attractions, making it the perfect spot to be.

Business Travel In Naples

Traveling to and navigating around this city is a breeze with the proximity of Naples Airport (NAP) and Southwest Florida International Airport (RSW). The city is conveniently located along Interstate 75, allowing for effortless access to all areas and a direct shot to East Florida.

Naples Entertainment

Naples isn’t all about work-life, and it’s a fantastic location to entertain clients, grow your professional network, and bond with team members. The location of our Concierge Executive Offices provides you with the most iconic and premiere location in Naples. With our offices located at 999 Vanderbilt Beach Rd, you are located within walking distance to Mercato shops, dining, and movie theaters, as well as a two-minute drive to the upscale Waterside Shops offering additional options for dining, shopping, and people-watching! In addition, Concierge Executive Offices are located centrally to the Ritz Carlton Beach Resort and the Ritz Carlton Tiburon Golf Resort, providing easy access to golf, tennis, beach, or dining options.

Naples is known as the golf capital of the world. With 92 golf courses in the area, you and your clients are sure to relax and unwind while discussing business. Every December, the Ritz Carlton Tiburon hosts the Grant Thornton Invitational bringing the best of the PGA and LPGA together for a weekend of fun, socializing, and golf!

Other entertainment options just minutes from Concierge Executive Offices include Artis Naples, hosting pop, symphony, opera, and musical shows year-round, or The Baker Museum hosting exquisite rotating art exhibits across various genres.

Concierge Executive Offices “CEO,” Everything You Need In Professional Office Space

Welcome to Concierge Executive Offices, where our team of highly skilled professionals provides exceptional amenities, services, and space in Naples. Representing your business in a forward-facing, professional manner and expertly managing your clients through our unmatched concierge service platform is our top priority.

Our prime location at Mercato, located at 999 Vanderbilt Beach Rd in North Naples, offers a range of options to enhance your experience and business. Adjacent to Capital Grille & Bar and Seasons 52, you can indulge in exceptional dining or explore the dynamic options for dining, dancing, cigars, cocktails, shopping, movies, events, and more in Mercato’s “triangle.”

At Concierge Executive Offices, we are confident in our ability to prioritize top-notch professional experiences for you and your clients. We treat your business as if it were our own and invite you to explore our offerings today. Contact us for a walkthrough, meeting, or more information. Rest assured that your business’s success is our top priority.

Visit https://ceonaples.com/ or contact us directly at (239) 325-5000.