Effective networking can be the key to unlocking new opportunities, partnerships, and growth in today’s highly competitive business landscape. For CEOs and business leaders, cultivating a strong professional network isn’t just advantageous – it’s essential. From expanding market reach to gaining insights from peers, networking can significantly influence your company’s success.

Why You Need to Focus on Networking as a Business Executive

Expanding Business Opportunities

Networking opens doors to new opportunities that might otherwise remain hidden. Building connections allows you to extend your influence beyond your immediate circle, whether it’s a new client, a strategic partnership, or access to untapped markets. As a business executive, having a vast network means you’re in a prime position to make introductions, referrals, and collaborations that benefit your business and others.

Gaining Industry Insights and Trends

Networking offers more than just business opportunities; it provides a chance to stay ahead of industry trends. Engaging with other business leaders, attending industry events, and participating in professional organizations can expose you to fresh ideas and innovations that help you stay competitive. Whether you’re working remotely through virtual office services or engaging face-to-face, regularly interacting with peers can provide insights into how other companies address challenges, manage growth, and prepare for future trends.

Enhancing Your Company’s Reputation

Your personal brand as a business leader can significantly affect your company’s reputation. Being known as a connected, well-respected leader who is involved in the business community adds to your organization’s credibility and stature. Participating in networking events, speaking at industry forums, and engaging with local business groups helps solidify your place as a thought leader in your field.

Developing Leadership and Communication Skills

Networking is an excellent way to improve your communication and leadership skills. By engaging with a diverse group of professionals, you’re constantly practicing how to present ideas, share your vision, and connect with others. Networking also allows you to step out of your comfort zone, leading to personal growth that can enhance your leadership abilities.

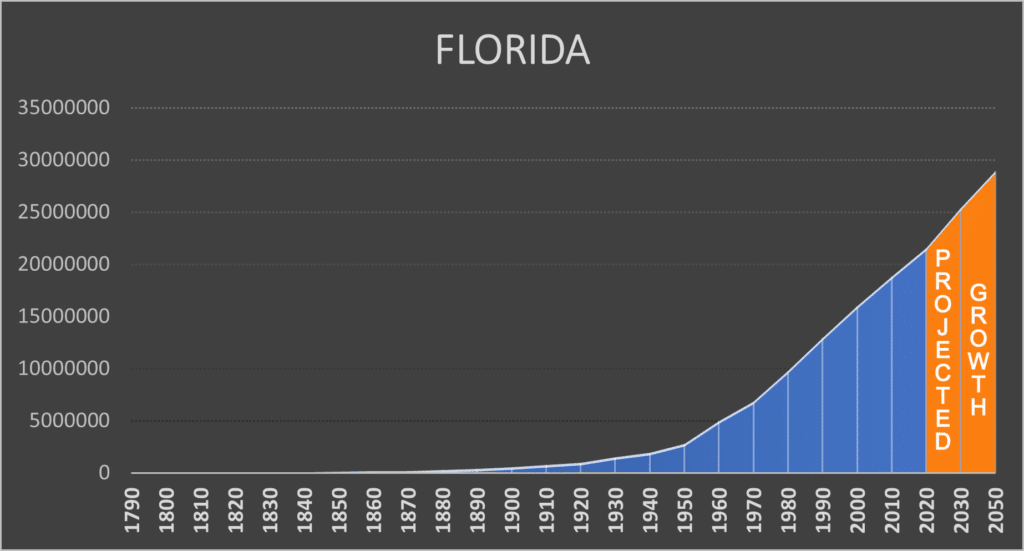

Where to Network in Naples, Florida

Naples, Florida, is home to a vibrant business environment with a variety of professional organizations and networking opportunities. Consider getting involved with some of these key business organizations in southwest Florida:

SWFL Inc. Chamber of Commerce – SWFL Inc. is a Five-Star Accredited Chamber of Commerce dedicated to supporting businesses across Lee, Collier, and Charlotte Counties by providing resources, networking opportunities, and advocacy for regional growth and success. Their mission is to foster a thriving business community in Southwest Florida.

Website: https://www.swflinc.com/

FGCU SBDC – The FGCU Small Business Development Center (SBDC) offers no-cost consulting, valuable resources, and expert guidance to help small businesses in Southwest Florida grow and succeed. They provide entrepreneurs with innovative tools and affordable education to support business development and sustainability.

Website: https://fsbdcswfl.org/

Greater Naples Chamber of Commerce – The Greater Naples Chamber of Commerce offers various events and programs to connect local business leaders. You’ll gain access to exclusive networking events, business expos, and educational seminars as a member.

Website: Greater Naples Chamber of Commerce

Naples Area Professional League of Executive Services (NAPLES) – NAPLES, a prestigious group of local executives and professionals, offers a platform to share insights and foster professional relationships. Joining this group is a testament to your influence in the Naples business community.

Website: NAPLES Executive Services

Leadership Collier Foundation – Leadership Collier Foundation develops leaders with a deep understanding of local issues, governance, and community needs. The networking opportunities within this organization can lead to powerful collaborations with other civic-minded CEOs and business owners.

Website: Leadership Collier Foundation

Young Professionals of Naples – If you want to support rising leaders in your organization, this group offers networking opportunities for younger executives. The Young Professionals of Naples provide mentorship and leadership development through networking and community involvement, empowering the next generation of leaders.

Website: Young Professionals of Naples

Women’s Business League – For women leaders in Naples, this professional network provides both support and development opportunities tailored specifically to female executives. Events include meetings, educational workshops, and community service projects.

Website: Women’s Business League

Networking as a Key to Business Growth

Networking is more than just making connections; it’s an opportunity to refine your communication skills and present your business effectively. Events provide valuable practice for perfecting your elevator pitch, which can be crucial when engaging with potential clients or partners.

Networking also keeps you up-to-date with industry trends, especially on platforms like LinkedIn, where you can build your personal brand, share expertise, and expand your professional reach. Engaging with peers and mentors helps you better leverage these tools to grow your influence.

Expanding your network leads to new business opportunities, partnerships, and market insights. Strengthening professional relationships and using tools like social media position your company for lasting success.

Unlock Success with CEO’s Executive Office Solutions

Incorporating these strategies into your networking approach ensures that you’re not only building relationships but growing your skill set and expanding your business in meaningful ways. Utilizing executive office spaces, corporate meeting rooms, and virtual office services allows you to enhance your professional presence and make the most of every connection. Contact CEO today for all of your executive office needs and let us help you leverage the right tools and spaces for your business.