Are you a business owner or entrepreneur looking to protect your brand identity in Florida’s vibrant marketplace? Filing for a trademark or service mark is a crucial step to ensure the security and exclusivity of your brand. Your trademark is a shield that safeguards your intellectual property, establishing the rights to your brand name, logo, or slogan.

In this guide, we’ll walk you through the process of filing for a trademark in Florida, covering everything from eligibility requirements to the application process and beyond, giving you the confidence and peace of mind that your brand is protected.

What is a Trademark?

Before diving into the specifics of filing for a trademark for your Florida business, it’s essential to understand what trademarks are and why they’re needed. A trademark is a form of intellectual property that has been legally registered so you have exclusive rights to use a particular name, logo, or slogan in connection with goods or services. Trademarks for service-based businesses, such as an oil change company or financial institution, are known as service marks. Trademarks and service marks are typically registered the same way and often referred to generally as trademarks.

By registering a trademark or service mark, you can protect your brand and business from infringement and unauthorized use by competitors, preserving your brand’s reputation and value. In addition to registering a trademark in Florida, you can also choose to seek wider protections for your Florida business with a US trademark filed federally.

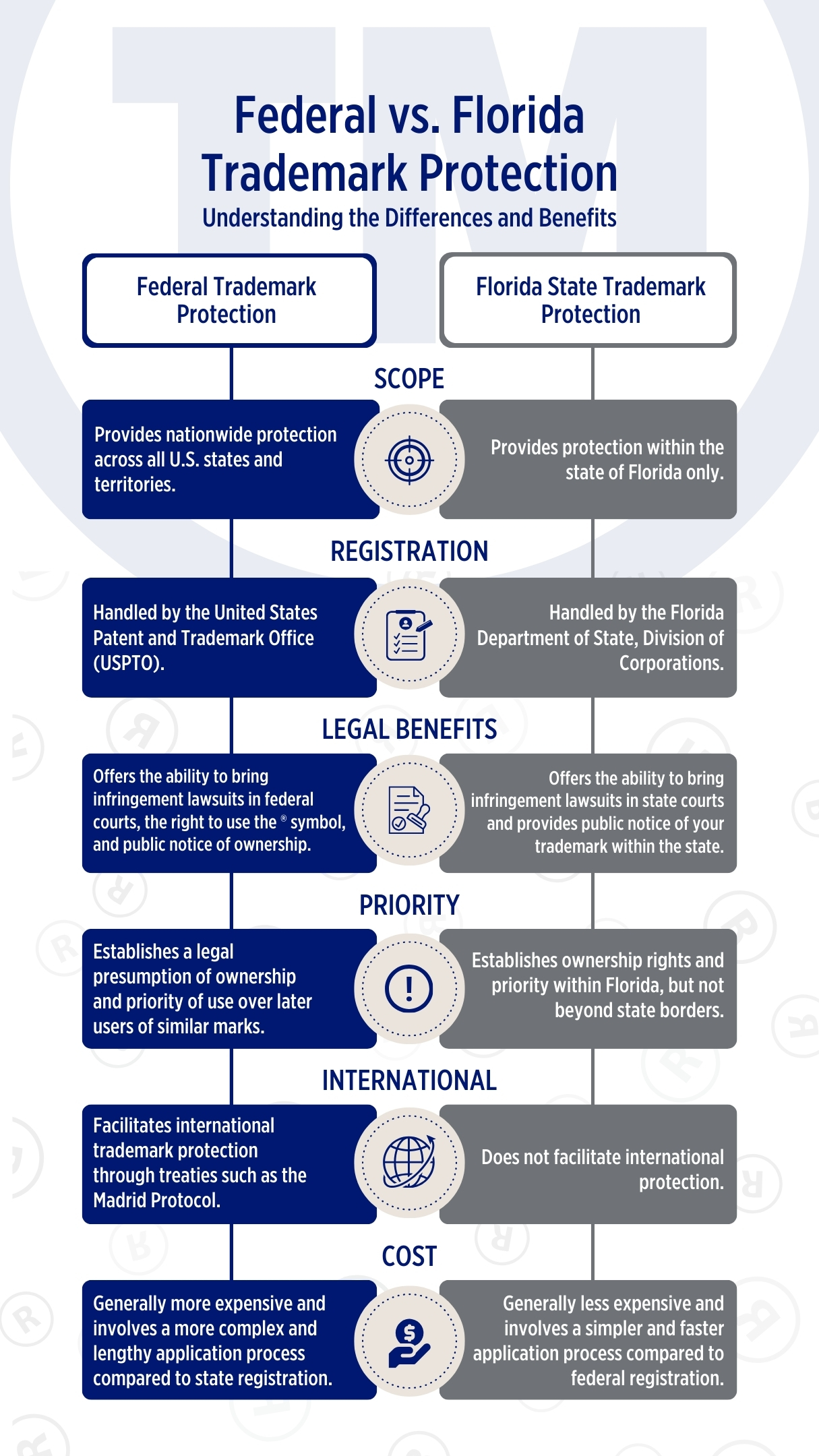

Federal Trademark Protection vs. Florida Trademark Protection

Both types of trademark registration offer valuable protection, but federal registration is generally more comprehensive and beneficial for businesses operating across multiple states or planning to expand. Technically, the US Patent Trademark Office (USPTO) is only authorized to regulate commerce when goods and services are available across state lines or internationally. However, this multi-state condition can often be satisfied by way of a website. Having said that, if you’re only doing business in Florida and have no plans to expand, a Florida trademark filing may be the best option.

Trademark Eligibility Requirements for Florida Businesses

Whether you need a state or federal trademark, your Florida business must meet specific eligibility requirements to file. These requirements include:

Use in Commerce

To file a trademark for your Florida business, you must show that you are already using it in business (“use in commerce”), or have a plan to use it (“intent to use”). You will need examples of your trademark being used and the date you first used that name or slogan. For products, proof of usage includes packaging labels or the product itself. Advertising materials alone aren’t enough for products but can suffice for services if the mark and services are clearly shown.

If you have yet to use your trademark, you need to be able to show a tangible plan of use in commerce. Doing so may clear the way to some limited protections and establish your business as the first to claim that trademark. However, you cannot be approved for or receive a trademark certification until you actually use the mark.

Distinctiveness

For a trademark to be eligible for registration in Florida, it must be distinct. This means that the mark should stand out from others in the marketplace while not being either overly generic or descriptive. Marks that lack distinctiveness are typically deemed ineligible for trademark protection.

The more distinctive a mark, the stronger its legal protection. Netflix(R) is a good example of a distinctive trademark. It is suggestive of the product, without being generic. Apple(R) is another good example. This trademark uses a common word in an arbitrary way, creating a distinctive expression of the business.

Non-Conflicting

When applying for a trademark, either in Florida or with the USPTO, it’s vital to ensure that your mark does not conflict with existing trademarks or infringe upon prior rights held by other parties. Conducting a comprehensive search before filing is essential to ascertain the uniqueness of your mark and avoid potential conflicts. These resources and databases can be very helpful when conducting a comprehensive trademark search to assess the availability of your desired mark and mitigate the risk of opposition or legal challenges from other trademark holders:

This is often where businesses bring in a trademark attorney. Attorneys that specialize in trademarks have additional tools and databases available to ensure your desired mark is free from conflicts, and can help you get through the application process. An experienced attorney may be especially helpful with a USPTO filing.

The Trademark Application Process

Once you’ve determined that your trademark is eligible for registration, the next step is to apply. To file in Florida, you would apply through the Florida Department of State, the official authority for trademark registration in Florida. To file for national protection, you would apply through the USPTO.

In either case, the application typically involves the following steps:

Preparing to File for a Trademark

In the preparation phase, business owners need to gather essential information and documentation to file for a trademark. This includes representing your mark, whether a logo, word, or combination. Additionally, you’ll need to compile a comprehensive list detailing the goods or services associated with your mark. Finally, be prepared to cover the necessary filing fees. Adequate preparation ensures that your application is complete and ready for submission, increasing the likelihood of a successful registration.

Filing the Trademark Application

Whether state or federal, filing your trademark application is straightforward and can be completed conveniently online. The application will prompt you to provide basic information about the mark itself (which you should have already gathered), such as its design or wording, as well as details about the owner of the mark. Additionally, you’ll need to furnish information regarding the mark’s usage in commerce, including specific goods or services it represents.

Application Examination & Review

In the state of Florida, your trademark application is reviewed by the Florida Department of State, Division of Corporations. This division is responsible for examining the application to ensure it complies with Florida trademark laws, including verifying that the mark is distinctive and does not conflict with existing registered trademarks in the state. This process generally takes several weeks from submission to registration, depending on the complexity of the application and whether any oppositions are filed.

Upon filing a federal trademark application, it will be assigned to an examining attorney at the USPTO who will review it for compliance with trademark laws and regulation. Be aware that current timeline for trademarks to be assigned to an examining attorney is approximately 10 months. During the review, the US attorney will assess whether your application meets all legal requirements, including distinctiveness and proper usage in commerce.

Trademark Publication

After successfully passing the examination with the USPTO, your federal trademark application then enters the publication phase. This involves publishing your trademark in the Trademark Official Gazette for 30 days. During this period, third parties can review your mark and raise objections if they believe it infringes upon their existing rights. This step serves as a public notice of your intent to register the trademark, allowing interested parties to voice any concerns before the registration process proceeds. This phase is vital as it ensures that potential conflicts are addressed before the trademark is officially registered, protecting both the applicant’s and third parties’ interests.

For a Florida trademark registration, the process is much simpler, and no publication period is required.

Trademark Registration

After the review period concludes , your trademark moves toward registration. If no objections are raised, or if any objections are resolved in your favor, the trademark for your Florida business becomes officially registered.

Once registered, you receive a certificate of registration, affirming your exclusive rights to use the mark in association with the designated goods or services. This certificate serves as formal evidence of your trademark rights and provides several benefits:

- Legal Protection – Registration gives you the legal grounds to prevent others from using a similar mark that could cause confusion among consumers. You can take legal action against any part that infringes upon your trademark rights. A Florida trademark protects you in Florida, and US trademark protects you nationally.

- Public Record – The registration creates a public record of your trademark, which can deter others from attempting to register a similar mark.

- Use of Registration Symbol – With a US trademark, you are also entitled to use the ® symbol next to your mark, indicating that it is registered and protected by law. Unfortunely, Florida trademarks do not permit the use of the ® symbol.

- Renewal and Maintenance – In Florida, the initial registration is valid for five years. You can renew your trademark indefinitely in five-year increments, provided you continue to use the mark and comply with renewal requirement. A US trademark is valid for 10 years and may be renewed in 10-year increments.

By securing registration, you formalize your trademark rights, making sure your brand is protected and providing a basis for legal recourse against potential infringement.

Maintaining Your Trademark

Maintaining your trademark’s registration requires ongoing diligence. Regular monitoring for unauthorized use and timely renewal of registration are essential to safeguard your rights and preserve the integrity of your brand. Should you discover any unauthorized use, you must take steps to defend and enforce your trademark, or you could lose your rights. You may need to send cease and desist letters, initiate legal proceedings, or pursue alternative dispute resolution methods.

Filing a Trademark: A Smart Move to Establish Your Business in Florida

As you establish your business in Florida, safeguarding your brand is crucial for long-term success. Trademarking your brand provides legal protection, ensuring that your unique identity is secure as you grow. This protection not only enhances your brand’s credibility but also allows for legal recourse against potential infringements.

If you are relocating your business to Florida and already have a US trademark, ensure that your contact information with the USPTO is up to date by submitting changes through the Trademark Electronic Application System (TEAS). Additionally, update your business registration with the relevant state authorities to reflect your new address.

Rely on CEO Naples for Your Premier Florida Business Address

Are you working to grow your Florida business? Do you need a place to call home? Get the Florida business address you need for legal documentation with an executive office or virtual office at our Naples office center.

Concierge Executive Offices offers tailored solutions, including executive office space and virtual office options, to accommodate your growing Florida business. With our comprehensive services, you can establish your presence in Florida seamlessly. We also offer notary services and other executive level support to help you achieve your goals. Contact us today to explore our offerings and find the perfect workspace for your business needs.

** Please note: This article is for informational purposes only, and should NOT be considered legal advice. For specific legal questions or concerns, contact a trademark attorney.

Federal Trademark Protection vs. Florida Trademark Protection

Both types of registration offer valuable protection, but federal registration is generally more comprehensive and beneficial for businesses operating across multiple states or planning to expand.